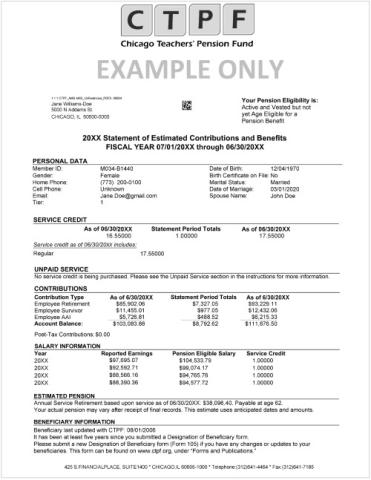

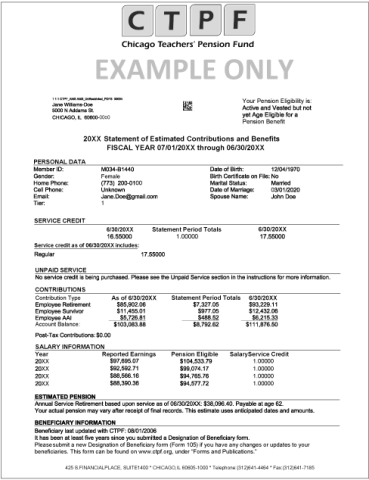

Every year in the fall, CTPF members who have not retired receive a Statement of Estimated Contributions and Benefits that summarizes the individual member’s contributions and service credit as reported by the employer(s) (CPS and/or Charter Schools and/or Contract Schools) for the previous fiscal year (fiscal years run July 1-June 30).

Accessing Your Statement

Annual member statements are available in the myCTPF Member Self Service Portal. Members should register at myCTPF.org to access their statements.

Personalized statements include the following information:

Personal Data

Verify that the information under the Personal Data section is correct. If information other than your marital data is incorrect, corrections should be made as follows:

- Current employees should contact their employer’s Human Resources department.

- Inactive or deferred vested members should contact CTPF Member Services at 312-641-4464.

If your marital data is incorrect, submit changes directly to CTPF, either by fax at 312.641.7185 or email imaging@ctpf.org (as .PDF or .JPG). When submitting a change, note the information to be updated and include your substantiating documentation (marriage certificate, divorce decree, and/or death certificate).

Member ID

You will find your unique Member ID at the top left of your Member Statement, under “Personal Data.” You may use either your Member ID or the last four digits of your social security number as an identifier when calling or writing to CTPF. To learn more about Member IDs, download the Your Member ID information sheet.

Benefit Tier

Members who joined CTPF or a qualified Illinois reciprocal pension system prior to January 1, 2011, are Tier 1. Members who joined on or after January 1, 2011, are Tier 2. The formula used to calculate pensions is the same for both tiers; however, vesting requirements, retirement age, and final average salary (FAS) calculation are different. Salaries used in the calculation of a pension are capped for Tier 2.

Service Credit

This section reports the years of service credit on file with CTPF. Any optional service that you have purchased and paid for in full is included under service credit.

Reciprocal Service Information

If you have reciprocal service with another Illinois system, it is listed here. Service credit will be verified at the time of retirement.

Contributions

Your contributions help to fund your pension, survivor pension, and your automatic annual increase (AAI). Contributions listed as “SPC” refer to payment(s) made on optional service contracts.

Salary Information

Your salary information is divided into two categories: Reported Earnings and Pension Eligible Salary. Pension Eligible Salary is the salary used to calculate your pension. Pension Eligible Salary does not include overtime, summer school, or after school pay. All salary information has been reported to CTPF by your employer.

Estimated Pension

This section provides an estimate of CTPF pension benefits accrued through the end of the previous fiscal year, payable at a normal retirement age. The benefit is based on your years of service, a pension percentage multiplier, and your final average salary (FAS). The estimate does not include service credit for any reciprocal service you may have. Final pension benefits are calculated based on your final record, after CTPF audit. Estimates are for informational purposes only.

Beneficiary Information

Beneficiary information indicates whether CTPF has a Designation of Beneficiary form on file for you. If you have not designated a beneficiary, or need to update your beneficiary information, please fill out the Designation of Beneficiary Form and submit to CTPF.